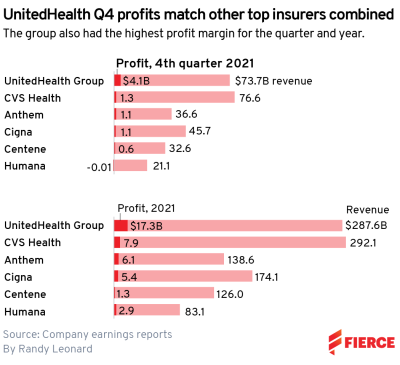

UnitedHealth Group was the most profitable payer in 2021, bringing in more than double the profit of its next-closest competitor with $17.3 billion in earnings.

CVS Health recorded the second-highest profit for the year among six major national insurers, earning $7.9 billion. CVS did bring in the highest revenue for the year, though, edging out UnitedHealth with $292.1 billion.

UHG reported $287.6 billion in revenue for 2021, according to the company's earnings report.

Both healthcare giants expect to top $300 billion in revenue this year, according to their forecasts.

RELATED: How UnitedHealth responded to the new federal requirement for home COVID-19 test coverage

UnitedHealth was also the fourth quarter's most profitable company, raking in $4.1 billion, which matched what its competitors earned combined, according to the filings.

UnitedHealth Group's results represented significant growth over both the full-year and fourth quarter of 2020. According to its earnings report, this was driven in part by gains in Medicare Advantage and Medicaid at UnitedHealthcare as well as another quarter of double-digit growth at Optum.

CVS was also the next-highest earner in Q4, with $1.3 billion in profit on $76.6 billion in revenue. UHG was just behind on revenue with $73.7 billion.

CVS Health executives said that the retail business outperformed expectations in the fourth quarter amid increased demand for COVID-19 tests and booster shots.

The healthcare giant performed 32 million tests and 59 million vaccine doses over the course of the year, with 8 million tests and 20 million vaccinations reported in the fourth quarter alone.

RELATED: Lynch: Enrollment in Aetna's ACA exchange plans lower than expected

While CVS and UnitedHealth duked it out for the top spot, all six of the big national payers were profitable for 2021, though Humana did post a $14 million loss for the fourth quarter.

Centene Corporation lands in sixth place for the year in profitability, bringing in $1.3 billion in profit on $126 billion in revenue. It also reported $599 million in profit for Q4.

Humana earned $2.9 billion for the year and $83.1 billion in revenue despite the Q4 loss, according to the company's earnings report. Executives said the insurer braced for headwinds related to COVID-19 during the year and also saw disappointing growth in new Medicare Advantage members.

As a result, Humana has kicked off a $1 billion value creation effort to reinvest in its core MA business in hopes of bouncing back from the underwhelming enrollment during the annual period.

Centene has been conducting a similar project throughout the year in an effort to streamline its operations.

Anthem and Cigna fall in the middle of the pack, according to our review. They both reported about $1.1 billion in profit for Q4, though Cigna was ahead with $45.7 billion in revenue.

Cigna reported $174.1 billion in revenue and $5.4 billion in profit for the year, and on its earnings call noted that a major growth opportunity moving forward its Evernorth subsidiary, which includes a slew of businesses such as Express Scripts, Accredo and MDLive.

Anthem earned $6.1 billion in profit on $138.6 billion in revenue for the year, and executives shrugged off concerns about the Medicare Advantage market, saying its performance in open enrollment met expectations. In addition, it's seeing growth at its in-house pharmacy benefit manager, IngenioRx, as it expands clientele.