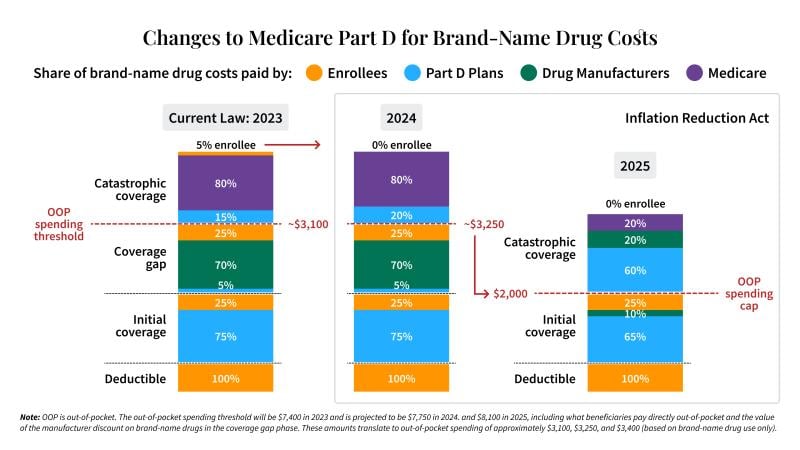

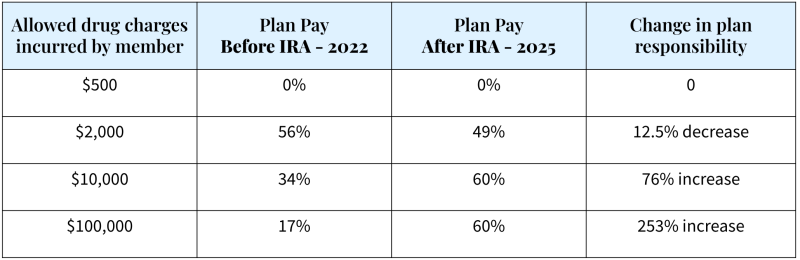

Medicare Part D plans have historically been shielded from the bulk of prescription drug expenses for higher cost members. However, under the Inflation Reduction Act, Part D plans will now pay most of the costs after the initial coverage period.

The Coverage Gap will Disappear in 2025

Thanks to the Inflation Reduction Act (IRA), by 2025, the infamous Part D coverage gap, will be eliminated. The IRA, which was signed into law in August 2022, substantially redesigns the Medicare Part D benefit and creates new incentives and opportunities to better control drug spending in Medicare. Fundamentally, these changes insulate Medicare beneficiaries from high drug spending and reduce taxpayer liability for Medicare drug spending by shifting more of the responsibility to insurance companies and drug manufacturers.

Under the IRA, Part D plans will be on the hook for 3x more risk during catastrophic phase

Historically, under the standard benefit package, Medicare Part D plans paid 15- 20 percent of the cost of branded drugs once beneficiaries entered catastrophic coverage. Starting in 2025, plan responsibility for catastrophic coverage will begin at a lower threshold and increase to 60 percent, representing a more than 3x increase in anticipated payments by the Part D plan.

This graphic shows the significant shift in drug spend liability for Part D plans (light blue).

What does this mean for a typical Medicare Advantage prescription drug plan?

Plan impact will vary considerably based on beneficiary utilization, individual plan benefit design and other elements unique to each offering. Moreover, it is impossible to know at this point how costs will ultimately be distributed once the additional IRA provisions (e.g., insulin cap, inflationary rebates, price negotiation and other provisions) are implemented. But, it is clear that the new design shifts the bulk of responsibility for branded drugs in the catastrophic phase to plans and eliminates the coverage gap phase, in which plans had previously been shielded from 95% of costs.

What should plans be doing NOW to prepare for this change?

Policymakers used the IRA to change the incentives so that plans would be encouraged to more carefully manage utilization, much like they do in the commercial market. Prior to the IRA, plans had little incentive to control Part D spend at higher levels because the risk was largely borne by taxpayers through reinsurance provisions; in addition, manufacturer pricing strategies appeared to speed beneficiaries through coverage phases to get to catastrophic. Virta Health’s Jonathan Pearlstein recommends four action items for plans that want to prepare for the forthcoming changes:

- Get effective lifestyle programs in place that focus on de-prescribing high-cost medications. One example is Virta’s diabetes reversal program, an evidence-based protocol that can help members reliably and durably eliminate or reduce insulin and other expensive diabetes medications and lead to clinically significant weight loss. Partner with vendors who offer robust performance guarantees around their outcomes to ensure positive return on investment. Prioritize these roll outs, like Blue Shield of California is doing, by adding Virta as an in-network provider and encouraging members to enroll.

- Expand condition management solutions for members on high-cost drugs who are not ready to reverse their disease. Offering a range of programs, particularly for those with chronic conditions like type 2 diabetes, chronic kidney disease and autoimmune disorders, will be even more important. These programs can support member choice and engagement while helping to ensure appropriate utilization.

- Leverage creative, targeted marketing campaigns to promote alternatives. Don’t wait until 2025 to drive change with your members. Kick-off targeted multi-channel, multi-touch campaigns now to generate interest. It takes more than one email or mailer to drive engagement. Best practices show you need a regular cadence to stay present with the large portion of people who are motivated to engage at various points in the year by a personal life event (e.g. losing a loved one to a specific disease or having a health scare).

- Consider plan design changes to incentivize alternative solutions. Leaders should explore plan design changes and formulary tools, including combination or step therapy, when clinically appropriate, where certain prescription drugs may be paired with evidence-based lifestyle programs that deliver sustainable health improvements. Moreover, to increase participation, plans may want to consider the use of incentives to drive engagement in programs with proven track records for reducing prescription drug utilization.

New survey shows significant beneficiary support and motivation for lifestyle programs

A 2022 survey by Virta Health of nearly 1,000 older adults with type 2 diabetes shows high interest and motivation in evidence-based lifestyle programs like diabetes reversal. More than 50 percent reported they are motivated to reverse their diabetes and get off their diabetes medications, but don’t fully understand how to do so.

Medicare Advantage members also said they would be significantly more satisfied with their plan if it offered diabetes reversal, and a diabetes reversal benefit would be a reason for 47 percent of them to switch plans.

While this is just the start of Part D changes in the Inflation Reduction Act, the shifting financial liability due to benefit redesign has major implications for plan leaders to consider now.