Last fall, it looked like the issuance of new government guidance settled the ongoing controversy over some health plans forcing physician practices to pay fees to receive their payments electronically.

But now the Centers for Medicare & Medicaid Services (CMS) has unexpectedly removed that guidance, which gave providers the right to refuse virtual credit card (VCC) payments that can cost them money and stopped payers from charging all but minimum transaction fees to receive electronic payments.

More than a week ago, CMS took down the FAQs that provided guidance on virtual credit cards and the payment of Electronic Funds Transfer (EFT) transaction fees. Robert Tennant, director of health information technology policy at the Medical Group Management Association (MGMA), told FierceHealthcare he hopes the agency will repost it.

RELATED: 1 out of 6 physician practices ‘fleeced’ with fees for receiving electronic payments

CMS had not responded to questions from FierceHealthcare about what happened to those FAQs by deadline.

But Tennant says it is important to practices that CMS reinstate the guidance so they are not subject to what he calls "unfair fees." Both MGMA and the American Medical Association have opposed mandatory VCC payments and transaction fees for years.

The AMA said it did not want to make any official comment on CMS' action. "The removal of the CMS guidance is a recent development and the AMA is assessing the situation," the group said in an email.

The reason for the opposition is the cost to practices, which face what’s typically a 2% to 5% charge when health insurers issue payments using a virtual credit card or tack on transaction fees for electronic payments.

Amounts vary, but for larger practices, the fees can amount to thousands of dollars, Tennant says.

Tennant calls the removal of the guidance from the CMS website disappointing, because practices thought the issue had been solved with the release of the FAQs.

CMS originally issued the guidance on payer-issued VCCs and EFT transaction fees on its FAQ page.

From paper to electronic payments

In the days before electronic payments, providers were paid with a paper check, which was expensive to both practitioners and health plans, Tennant says. In 2010, the Affordable Care Act standardized healthcare business practices, EFTs and electronic remittance advice (ERA).

Operating rules released in 2014 requires all insurers, not just Medicare and Medicaid, to offer electronic payments upon a provider's request.

Some payers began using VCCs to pay providers. But every time a practice puts through a charge, a fee is attached by the credit care company, typically 2% to 5%. Tennant compares it to someone receiving an electronic paycheck from their employer and seeing money lopped off their deposit.

“It’s so grossly unfair,” he says.

The guidance confirmed that providers cannot be forced to accept VCCs. It gave providers the right to request a health plan use the EFT transaction. If a provider makes the request, the health plan must comply. As it stands right now, without the FAQ, there is no prohibition against payers using VCC payments, he says.

Then there was the issue of some health plans and their contracted payment vendors forcing practices to pay fees to receive their payments electronically through EFT transactions. Some assessed percentage-based fees, usually 1.5% to 2% for delivering payments to providers.

As with the virtual credit cards, practices lost income from their contracted rates with health plans because of the administrative fees.

The FAQ limited transaction fees to the small charge applied by the provider’s bank, which averages 34 cents per transaction. Also, health plans and vendors cannot require providers to pay for additional “value-added services” they did not request, Tennant said. Those are services such as 24-hour hotline numbers, consolidation of payments, prompt payments and special output of the remittance advice.

The FAQs also took care of a concern by providers that payers will use EFT capabilities to recoup overpayment by debiting an account without their knowledge. The guidance prohibited payers from removing money without provider permission, Tennant says.

Physician practice leaders talk numbers

The MGMA has polled its members about both EFT payments and use of VCCs.

In September 2017, an MGMA STAT poll found 17% of 876 respondents indicated that their EFT payments from health plans came with a fee—often up to 2% of the total payment. Another 50% said there was no fee attached to the transaction, but more than 32% indicated that they were unsure.

About 1 out of 6 providers pay fees to receive electronic payments, according to #MGMAStat: https://t.co/pJ4yUPMyG2 pic.twitter.com/0Gt2S9cXxn

— MGMA (@MGMA) September 12, 2017

RELATED: MGMA Stat poll finds about one out of six providers pay fees for receiving electronic payments

Of those who responded yes to receiving fees for EFT payments, almost 60% stated that these health plans use a third-party payment vendor.

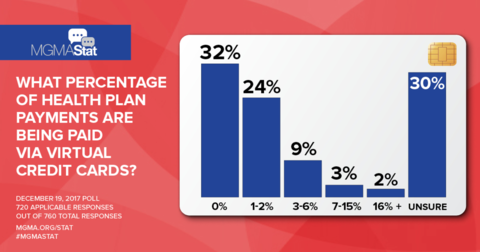

MGMA polled medical groups in one of its STAT polls last December, asking what percentage of their health plan payments are being paid via VCCs. The poll found:

- 24% of respondents noted that 1% to 2% of their payments were delivered via VCCs.

- 12% indicated VCCs made up 3% to 15% of payments.

- 2% of respondents stated they were receiving 16% or more of their payments via VCC.

- 32% of respondents stated they received no VCC payments, and an additional 30% were unsure.

In a separate survey that asked about practice’s top regulatory concerns, 59% cited payer use of VCCs.

Tennant says he hopes physician groups can convince CMS to repost the guidance. In the meantime, practices should review all payment contracts closely and push back when possible on health plans or vendors who impose fees on their electronic payments.

In a report released last fall, the Workgroup for Electronic Data Interchange (WEDI), a health IT adviser for the Department of Health and Human Services, said concerns about overpayment recovery among providers are among the issues that have limited the adoption of electronic payments designed to streamline administrative tasks.