Employers want alternative ways to provide medical benefits to their retirees over the next three years, with some looking to replace their traditional group plans for pre-Medicare and Medicare-eligible retirees with individual insurance coverage through private marketplaces, according to a survey by Willis Towers Watson.

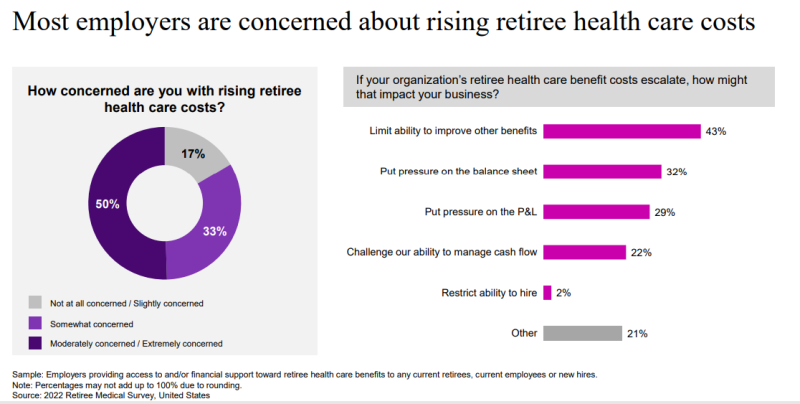

Employers are motivated by cost, as they expect to pay more in the next three years to provide benefits to this group, the survey found.

Lindsay Hunter, WTW’s senior director for health and benefits, said in a press release that for now, employers “remain committed to offering retiree healthcare benefits and a positive retiree experience. But they’re looking for ways to provide them more cost effectively. Employers are rightfully concerned about this growing burden and are studying all options, including private marketplaces.”

The consulting company’s 2022 Retiree Medical Survey includes information from 122 employers that employ about 1.9 million workers. The survey was taken in July and August.

One in 8 employers (13%) expect to make changes to their retiree medical benefits over the next three years, according to the survey. Some employers have already made moves to cut healthcare costs for this demographic, with 1 in 5 (22%) not offering a traditional group medical plan, and 75% of those companies replacing it with efforts to steer retirees and near-retirees to individual plans in the private insurance marketplace.

Those efforts include financial support.

“Nearly half (49%) expect to introduce change because the benefits are too expensive for the company to maintain,” the press release states. “Over a third (36%) are looking to address unacceptable financial risks, while 33% cited the need to reduce the plan’s administrative burden.”

Trevis Parson, WTW’s chief actuary for Via Benefits, said in the press release that “the recent passage of the Inflation Reduction Act is making private insurance marketplaces for individual coverage an even more attractive option for retiree benefits. In particular, the extension of premium tax credits and the improvements to Part D plans position private marketplaces to better offset rising healthcare costs for both organizations and their retirees.”

The survey asked employers that have already made changes to their retiree health benefits what factors influenced them to a very great extent. They responded:

- The benefit is too expensive for the company to maintain (49%)

- The plan is presenting unacceptable financial risks (36%)

- The administrative burden in terms of cost, talent and time is too excessive (33%)

- To address collectively bargained requirements (23%)

- Need to align the retiree medical plan with changes to our organization’s defined benefit/defined contribution retirement income plan(s) (22%)

- The competition is making changes to which we need to respond to remain competitive (10%)