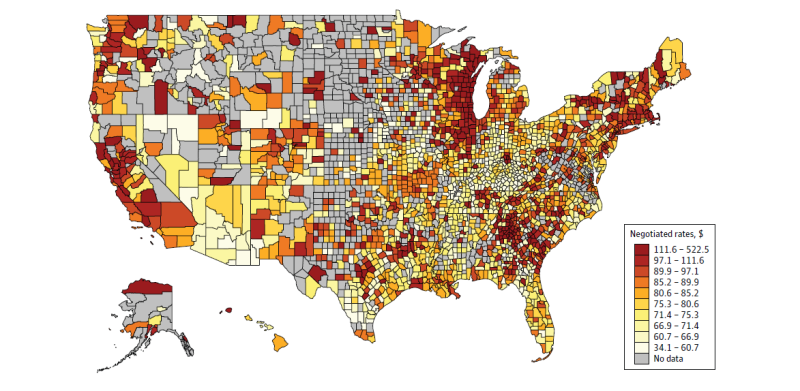

Patient office visit costs were lowest in counties in Florida and the central U.S., and prices were the highest in the upper Midwest and Southeast, according to health payer Humana’s negotiated rates for seven procedures.

The findings, published in JAMA Health Forum, is one of the first studies to examine price transparency at a regional level. The seven procedures included more codes such as computer tomography scans and high-severity emergency department visits.

The study’s authors said Humana rates were chosen because of its national coverage of clinicians and facilities, restricting analysis to in-network providers. They then matched performance of selected services from 2019 fee-for-service claims data from the RAND hospital price transparency project, evaluating differences in prices. The goal, long term, is to see whether cost translates to quality of service.

“Importantly, many higher-priced counties bordered lower-priced counties,” the report said. The mean county-level price was $86.

Other procedures studied included colonoscopies, lower-extremity MRIs, hip arthroplasty, lipid panels and patient office visits, which made up most of the data points in the study sample. Patient office visits ranged from $69 to $114, while hip arthroplasty procedures ranged from $1,231 to $1,930.

It’s expected the study is just one in a line of future reports that will study more insurers, procedures and health policies at a larger scale. This analysis did not infer underlying causes but noted that policymakers need to find balance in spending financial resources and receiving high-quality care.

“However, if price variation is driven by consolidation or anticompetitive contracting, then regulators should design policies that ensure competitive health care markets,” the study said.

Until enactment of Hospital Price Transparency and Transparency in Coverage rules, price transparency was largely nonexistent for the private market. New payer data will be released each month by all payers, furthering efforts to know prices for procedures.

Many counties were not accounted for in this study, as several central and western states had numerous counties with no data.