Enrollment in Medicare Advantage (MA) has exploded over the past 15 years, a new study shows. However, the researchers warn that payment policy hasn't kept up with the times.

From 2006 to 2022, MA enrollment increased by 337% as enrollment in traditional Medicare declined by 2.9%, according to a study in Health Affairs. Meanwhile, the number of Medicare beneficiaries grew from 41.8 million in 2006 to about 63 million in 2022, the researchers found.

In addition, the study found that while the presence of traditional Medicare across counties has declined, MA’s presence has grown. In 2006, 86% of counties showed less than 15% of MA penetration, and, by 2022, that shrank to 10.6%.

By 2022, 32% of counties had seen MA penetration between 45% to almost 60%, with 10.6% having MA penetration of 60% or more. In addition, MA enrollment for Black, Asian and Hispanic beneficiaries is higher than for white beneficiaries, the study found.

“The dramatic growth in MA penetration during the past two decades indicates that beneficiaries are reforming Medicare with their feet,” the study concluded. “Policy discussions about the future of the Medicare program would be well served by recognizing these trends and accounting for the dramatic shifts in the preferences exercised by Medicare beneficiaries in recent years.”

Researchers gathered data from the Medicare Master Beneficiary Summary Files, which can be accessed through the Centers for Medicare & Medicaid Services’ Virtual Research Data Center.

They reviewed enrollment data for March of each year for traditional Medicare Part A, which covers inpatients or skilled nursing facility care, and Part B, which covers outpatient and professional care. They also looked at MA enrollment data. Commercial insurance companies administer MA plans, with benefits packages that typically include prescription coverage.

MA plans are paid based on the average cost per beneficiary in traditional Medicare in each county. The study noted that the trends researchers reported “may raise concerns about the stability and accuracy of MA benchmarks, the target against which MA plans bid. Because these benchmarks are set according to spending among traditional Medicare beneficiaries in the county, using spending data from residual traditional Medicare enrollees may become an increasing concern as MA penetration rises.”

Paul Ginsburg, Ph.D., a senior fellow at the USC Schaeffer Center and one of the study’s authors, tells Fierce Healthcare that he sees the study as a wake-up call to policymakers “about how large MA is now and a reminder that the current approach of basing MA payment on the costs of traditional Medicare is becoming more and more problematic as MA grows.”

Ginsburg cites a Brookings Institute policy paper (PDF) that he cowrote in 2018 that recommends a competitive bidding approach to setting MA payments.

“Health plans have feared such a policy for a long time, having blocked demonstrations of it,” says Ginsburg. “But I would say the awareness of the magnitude of overpayment in MA has grown over time, so in the future, policy might not be as favorable to the plans as it is now.”

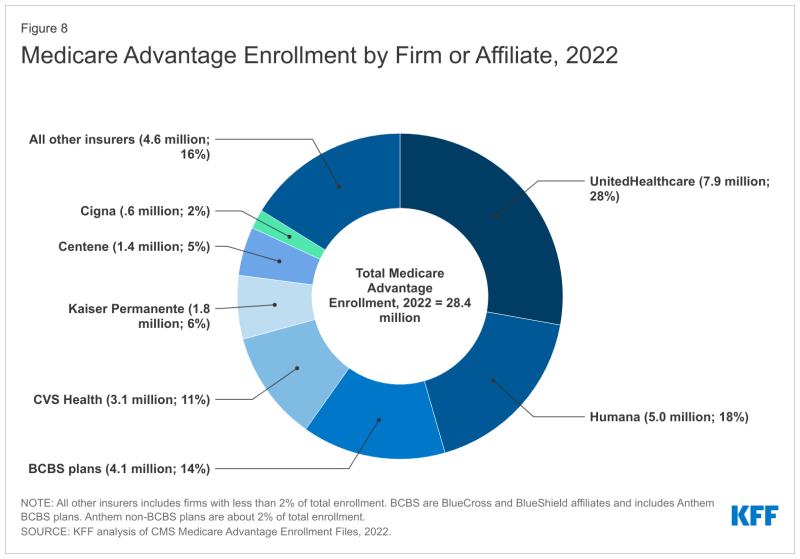

UnitedHealthcare, Humana and Blue Cross and Blue Shield plans comprise about 60% of the MA market, according to the Kaiser Family Foundation.

Ginsburg believes that health plans won’t exit the program if a competitive bidding process becomes reality. “MA appears to be the most profitable segment of the insurance market and plans are piling in to expand at the present time,” he says.