Payers the world over expect to see healthcare benefits costs jump in 2023 to their highest level in 15 years, but they’ll rise less in North America than in other parts of the world, according to a survey by Willis Towers Watson.

In addition, the 257 leading insurers representing 55 countries put some of the blame for the increase on two other healthcare stakeholders: providers and beneficiaries. Providers because they overprescribe and recommend too many services to patients, and members because of their poor lifestyle choices.

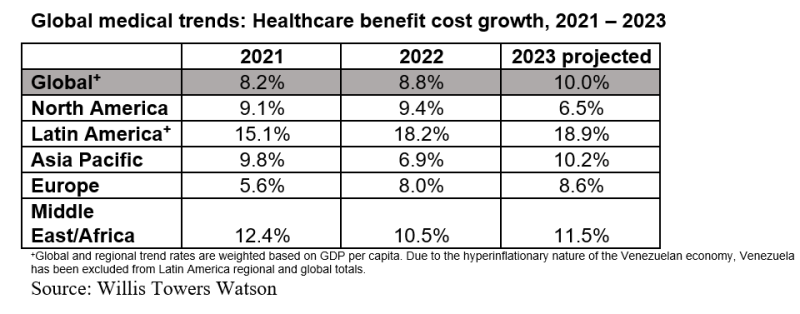

Add inflation to the mix, and insurers expect global healthcare benefits cost to rise 10% next year.

“The one region where a decrease in trend is expected is in North America, projected to drop from 9.4% in 2022 to 6.5% in 2023,” according to the survey’s executive summary. “While this would be welcome news, U.S. employers in particular are not necessarily seeing this impact them yet and remain very concerned on cost and volatility—despite the fact that inflation overall may be abating for the coming year.”

The unprecedented worldwide COVID-19 pandemic continues to present unprecedented challenges to payers. Eric McMurray, WTW’s global head of health and benefits, warns insurers and employers in a press release, that “old solutions will not work. Cost shifting is not an option. There’s a critical need for innovation, strategy and new solutions to have any substantive impact.”

Expected cost increases break down this way:

- Latin America, from 18.2% to 18.9%

- Asia Pacific, from 6.9% to 10.2%

- Middle East and Africa, from 10.5% to 11.5%

“Even Europe, which has traditionally seen much lower levels in the past, is not excluded from the record levels of trend,” the executive summary states. “For 2023, the Europe trend is expected to increase to 8.6%, which is a significant jump over 2021 levels (5.6%).”

The 10% increase comes on the heels of an 8.2% increase in 2021 and an 8.8% increase in 2022.

In addition, payers don’t as yet see an end to the trend, with 78% expecting health benefits cost to increase significantly in the next three years. Insurers blaming the overuse of medical services by providers for cost increases rose from 64% in 2021 to 75% this year. In addition, 52% of respondents blame the poor lifestyle choices by members for the increase, a big jump from the 35% who said that last year.

COVID-19 casts a shadow over the survey when insurers were asked about specific conditions that drive costs. Musculoskeletal disorders ranked first for which claims were filed. “This finding likely reflects the ongoing impact of poor ergonomics in employees’ home working environment combined with reduced levels of physical activity during the pandemic,” the executive summary states. Cancer, the fifth leading condition in terms of claims filed in 2022, will most likely move up to No. 2, which the WTW survey attributes to all the delays in diagnosis and care that COVID-19 forced.

Then there’s mental health. “In our 2022 study, mental and behavioral disorders were ranked among the top five conditions by cost but not by incidence of claims,” the executive summary states. “Respondents expect mental and behavioral disorders to be among the top five fastest-growing conditions by both incidence of claims and cost in the next 18 months.”

Seventy percent of insurers called contracting with provider networks the most effective way to control costs.

“A notable shift over prior year occurred in the area of preapprovals for scheduled inpatient services, which dropped from number two (67%) last year to number five (52%) this year,” according to the executive summary.

In addition, telehealth moved from number three to number two as one of the best cost-cutting techniques, even though the percentage dipped a bit from year to year. Last year, 63% of respondents said telehealth was a good cost-cutting tool, while this year 60% said so.