Insurers have plenty to consider when weighing coverage for new weight loss medications, and that includes the need to carefully coordinate distribution with their pharmacy benefit managers, according to a new playbook.

Payers should also be prepared to monitor legislative action that might make the decision not to cover these drugs more difficult, according to the guide from Goodroot, a conglomeration of companies that is aiming to making healthcare better and more affordable.

The weight loss drugs in question include not only GLP-1 products like Ozempic and Wegovy but also drugs in the Food and Drug Administration’s pipeline such as Mounjaro and Rybelsus. Though it was developed as a diabetes medication, Rybelsus’ manufacturer, Novo Nordisk, wants the FDA to approve it as a weight loss drug.

The Goodroot guide said that only 25% of health plans cover weight loss medications with prior authorization and 10% to 15% of plans allow coverage without it. A self-insured employer or health plan that currently doesn’t cover the new weight loss medications needs to make sure that their PBM holds the line.

“Given that prescribers are already initiating off-label usage of these drugs, it’s crucial to clearly communicate with your PBM—and check your PBM contract—to ensure drug utilization controls are in place to ensure that these drugs are only used for patients who have diabetes,” the guide states. “Although a PBM may list the drug on their formulary, the decision to provide coverage for the medication still falls upon the plan sponsor.”

In addition, payers should:

- Review PBM formulary and utilization management systems to ensure that only clinically eligible patients get the drugs

- Negotiate lowest-net-cost PBM formulary changes to obtain the medications at the lowest prices

- Contract with a PBM that approves of manufacturer copay cards for non-specialty drugs, which can lower the cost burden on the payer

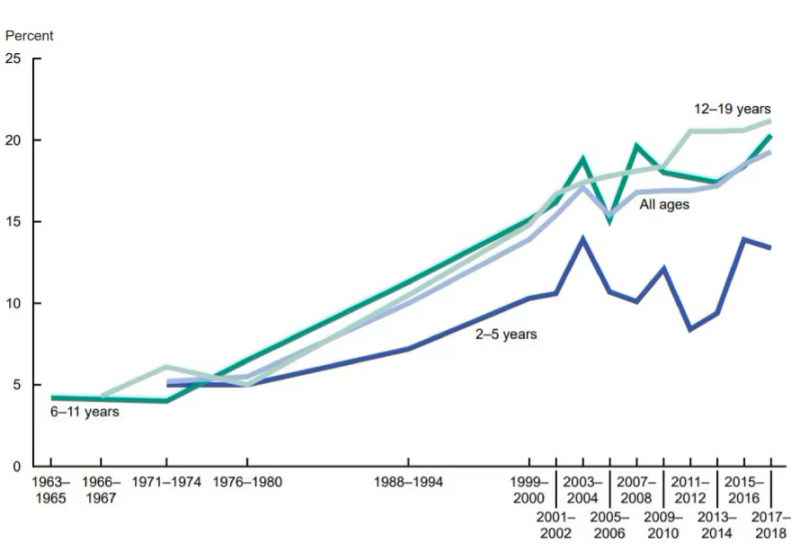

The weight loss potential cannot be easily dismissed on either a clinical or financial basis, according to the guide. The guide’s authors wrote that the American Medical Association labeled obesity a chronic condition in 2013, and the economic impact of the condition rose from $976 billion in 2014 to $1.4 trillion in 2020, according to a report by the Milken Institute.

“Employers and plan sponsors shoulder a substantial portion of obesity-related expenses, prompting the question: Could these weight loss drugs be a solution?” the Goodroot guide said. “Covering weight loss medications will be a significant expenditure for payers on the pharmacy benefit but could potentially result in long-term savings.”

Arguments against coverage aside from the steep cost include the lack of historical data on efficacy and reports of gastrointestinal disturbances such as constipation, diarrhea, nausea, vomiting and severe abdominal pain. In addition, clinical evidence suggests the drugs elevate the risk of pancreatitis, pancreatic cancer and gallbladder problems and adversely affect the bile ducts in the liver.

Commercial health plans and self-insured employers often take their cues from Medicare and, so far, Medicare won’t cover these medications for some of the reasons listed above. This could change, however, under the Treat and Reduce Obesity Act, which would allow Medicare Part D to cover these medications. The legislation has languished so far, but the buzz about Ozempic and the other drugs might spur lawmakers to act.

“This extension would not only expand access to these medications for those aged 65 and older but could also set a new standard for coverage, influencing commercial plans,” the Goodroot guide said.

Ralph Pisano, president of Goodroot affiliate company Nuwae, told Fierce Healthcare that the path toward coverage for payers might be similar to what went on with Botox, Viagra and medications for hepatitis C, except that advances in social media and its ubiquitousness speed up the patient demand and payer pushback dynamic.

“Instagram and TikTok; things like that,” said Pisano. “If you scroll down TikTok you’ll see people saying, ‘I wish I would have started Ozempic sooner.'”

The celebrity culture also contributes to making Ozempic famous as witnessed by a joke at this year’s Oscars which credited the drug for the impressive physiques of those in attendance.

Ozempic will be pushed aside somewhat by Mounjaro which, unlike the other weight loss drugs, contains two distinct mechanisms of action to achieve exceptional weight loss results, Pisano expects.

At the moment, Mounjaro is a diabetes drug, but Pisano said that the FDA is currently examining data on whether to include it in the weight loss class, and that decision might come in October.

“In my experience over time, it seems like a couple of drugs will become market leaders,” said Pisano. “Ozempic in general is a diabetic drug and that dosing is very different than it should be for weight loss. You’re getting a lot of wastage up to the titration to the dose where you need for weight loss. A lot of people are not successful on Ozempic, although they use it very much. I think Mounjaro is going to become the market leader.”

Patient churn must also be considered, Pisano said. “That churn on a patient might be a year or two years or whatever it may be,” he said. “You may be paying for the upfront costs, and another payer may be getting the benefit. The person may move to a different employer or a different health plan.”

Randy Vogenberg, Ph.D., a nationally known expert on pharmacy and healthcare insurance issues, told Fierce Healthcare in an email that coverage of the weight loss medications has so far been a “mixed bag,” but “generally the goal is to couple any use of this drug category for weight loss within their existing integrated plan offerings. Having counseling, support groups, and regular medical check-ups are all part of the options in effectively achieving then sustaining weight loss.”

Vogenberg also cited reports of medical problems after one or two years of using the medications. “There remains a lot to learn and know about these drugs, so it is a concern of employers, not just financial, but the health and well-being of their covered members.”