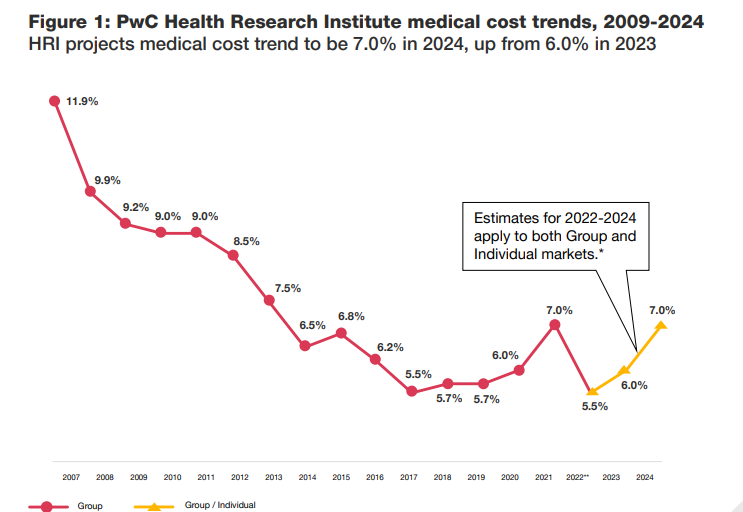

Healthcare costs will balloon 7% next year, as payers hammer out new contracts with providers, the labor shortage stretches on and drug prices continue to increase, according to a new report by PwC.

This represents a jump from PwC cost increase estimates in 2022 (5.5%) and 2023 (6%)

Researchers with PwC’s Health Research Institute spoke to insurance actuaries who work with health plans that cover over 100 million enrollees in employer-sponsored health plans and about 10 million individuals in plans on the Affordable Care Act marketplace.

However, the estimate is not set in stone, as the report said PwC adjusted its medical cost projection for the group market from 6.5% to 5.5% for 2022 due to fewer individuals receiving inpatient hospital care, as they opted instead to get care from outpatient sites.

“The higher medical cost trend in 2024 reflects health plans’ modeling for inflationary unit cost impacts from their contracted healthcare providers, as well as persistent double-digit pharmacy trends driven by specialty drugs and the increasing use of the GLP-1 agonists for Type 2 diabetes or weight loss,” the report said.

Health plans expect hospitals and physicians to seek not only rate increases but also shorter gaps between new contracts. Physician burnout and greater demand for surgeries and procedures post-COVID will also add to inflationary pressures, according to the report.

“Many health plan actuaries said they are facing increasing inflationary pressure on unit cost in 2023 and 2024,” the PwC report said. “Their ability to manage price increases during contract renewals will be a key factor in determining how the impact of inflation will materialize in the coming years.”

Employment in healthcare began to start recovering from the systemic shock rendered by COVID-19 in 2022, but there’s still a shortage, especially in nursing and workers in long-term care facilities and insurers can’t envision any short-term fix for this problem.

“Assuming the persistence of such shortages in 2024, hospitals will continue to be financially challenged and forced to seek higher reimbursement from payers,” the PwC report said. “On the other hand, if healthcare employment levels return to a stable level in 2024, pent-up demand for care is likely to drive utilization up. In both cases, health plans can expect to face inflationary pressure in 2024.”

Though health plans will continue to face a rising median price for new drugs, as well as price hikes for existing drugs, there are some deflationary indicators as well. For instance, biosimilars cost about 50% less than their reference drugs.

“The launch of adalimumab biosimilars to Humira in 2023 is a new milestone in the market that is already driving significant savings,” the PwC report said

Health plans see other factors at play for the rest of this year and next year, and while those might spur hope for controlling costs, that hope will arrive sometime in the future, having negligible effects on what’s going on now.

For instance, insurers will keep investing in total cost of care initiatives such as value-based care.

“National health plans generally demonstrated better cost management and subsequently achieved lower cost trends,” the PwC report said. “As these national plans continue to grow, they will have a deflator effect overall on medical cost trends.”

In addition, while health plans expect the demand and utilization of behavioral healthcare to rise, that won’t be a major inflationary problem, as behavioral healthcare is less expensive than other medical costs, according to the report.