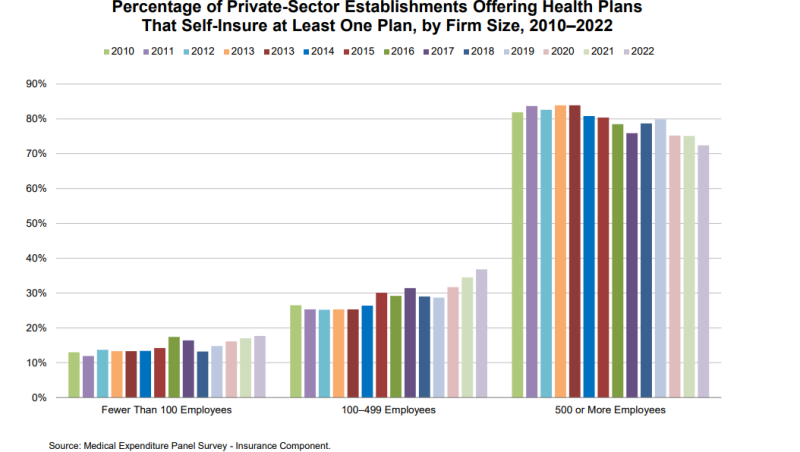

As large employers take a step back from self-insurance, small- and medium-sized employers are taking a step forward in embracing that coverage option, according to an issue brief by the Employee Benefit Research Institute (EBRI).

“Since 2018, the percentages of small and medium-sized establishments offering at least one self-insured plan both increased,” according to a summary of the nine-page issue brief. “In contrast, the percentage of large establishments offering a self-insured plan has declined. The decline among large establishments occurred in most years since 2013.”

Paul Fronstin, Ph.D., director of health benefits research at EBRI, told Fierce Healthcare that the decline in large employers offering at least one self-insured option needs to be studied.

“It’s not a drastic change,” Fronstin said. “It’s a very small erosion. But something’s going on there, and we’ve got to figure out what it is.”

Using data from the Agency for Healthcare Research and Quality’s Medical Expenditure Panel Survey—Insurance Component, EBRI divides the employers into three categories: small, fewer than 100 employees; medium, 100 to 499 employees; and large, 500 or more employees. The share of large employers offering self-insurance options to employees steadily declined since the Affordable Care Act's (ACA’s) passage, dropping to 72% in 2022, the lowest it’s been since 2010.

“Overall, the percentage of workers in self-insured plans has been bouncing around between 58% and 60% since 2010 but fell to 55% in 2022,” according to the issue brief. “This occurred despite the increase in self-insurance among small and medium-sized companies because of the drop in self-insurance among large firms.”

The number of private sector workers in self-insured plans varies widely across states, from 33% in Hawaii to 70% in Ohio. “This is likely due to differences in state laws related to regulation of fully insured plans and characteristics of employers in that state,” the issue brief states.

The increase in the number of small- and medium-sized companies offering self-insured options had been an expected byproduct of passage of the ACA in 2010, which encouraged that change.

There’s been some ebb and flow. Between 2013 and 2016, the number of small companies that self-insured grew from 13.2% to 17.4%, but then fell to 13.2% again by 2018. However, it rebounded, and by 2022 stood at 18%, according to the issue brief.

Medium-sized employers also experienced ebb and flow in terms of the number that self-insure. There’d been an increase between 2013 and 2015, then between 2015 and 2020 the percentage “bounced around” between 29% and 32%, according to the issue brief. In 2022, the share jumped to 37%, the peak level of medium-sized employers over the time span examined.

Fronstin said that although “nothing surprises me,” he did find the backing off from self-insurance among large companies a finding he hadn’t expected.

“I’m not hearing it anecdotally from large employers that they’re pulling back on self-insured plans,” Fronstin said. “And, you know, one or two years of changes, to me isn’t significant. But the longer-term trend is there. There’s no question it’s there. What I would like to do in the future is try to dig into it.”

Fronstin isn’t the only one who wants to find out more about self-insurance among all sizes of employers. “Now you’ve got this proposed rule change by the U.S. Department of Labor,” Fronstin said. “They want more information about this. Because there’s a lot that’s not known in terms of what a self-funded arrangement looks like among small- and medium-sized companies.”