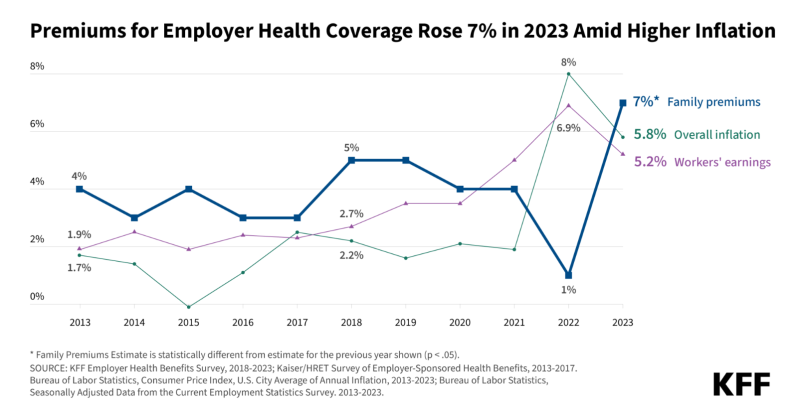

Family premiums for employer plans are set to rise by 7% on average this year, one year after virtually no growth, according to a new analysis from KFF.

KFF expects that family premiums will average $23,968 this year, according to its annual benchmark survey. The report projects that employees will contribute $6,575 toward that premium on average, up $500 from last year's survey.

People who work at firms with fewer than 200 employees contribute $2,500 more to their premiums than those at larger firms, according to the study. The study found that a quarter of people working at smaller firms contributed $12,000 or more to their premiums each year.

“Rising employer health care premiums have resumed their nasty ways, a reminder that while the nation has made great progress expanding coverage, people continue to struggle with medical bills, and overall the nation has no strategy on health costs,” KFF President and CEO Drew Altman said in a press release.

The survey includes data from 2,100 employers. More than 153 million people in the U.S. rely on medical coverage through their employer, KFF noted, making the cost fluctuations critical to track.

Nearly all employers with at least 200 workers offer benefits to at least some of their workers, but, as small firms get smaller, they become increasingly less likely to offer benefits. For example, while 83% of companies with between 10 and 199 employees offer benefits to at least some of their workers, that number drops to 42% for firms with between three and nine workers.

The study did identify significant growth in the number of companies offering dental and/or vision coverage in additional to medical coverage. Most (91%) offer separate dental coverage and 82% offer vision. By comparison, 46% offered dental coverage and 17% offered vision coverage in 2010.

In addition to tracking overall trends in the cost around employer coverage, the survey digs into several key concerns that are grabbing headlines. For one, it found that among employers with over 200 employees, 10% said they do not cover legal abortions under any circumstances.

In addition, 18% said they only cover legal abortions under specific circumstances, such as in cases involving rape, incest or potential risk of health or mortality. About a third (32%) said they cover legal abortions in all circumstances.

However, the rapidly changing landscape in the wake of the Dobbs decision makes this difficult for employers to navigate, the survey found. Four in 10 of those surveyed said they were unsure what their abortion coverage looks like, as it was in flux or they did not know the details.

The largest employers, or those with more than 5,000 workers, were the most likely to say they would cover the travel expenses for an employee to travel to another state to obtain an abortion, with 19% offering coverage.

Mental health access and network adequacy is also a major concern for employers, the survey found. While most (88%) of large employers said they believe their plan provides timely access to primary care, just 59% said the same about mental health care.

Eighteen percent of those surveyed said they took steps this year to grow their mental health networks. That said, 21% reported that their plans have limits on the number of covered services for mental health, which could limit employees with long-term needs.

“For several years now, the survey has shown that many large employers do not believe that their networks have enough mental health providers to provide timely access to care. In 2023, many large employers, including nearly half of the largest employers, say that they are taking steps to better meet enrollees’ needs,” said Gary Claxton, a KFF senior vice president and the study's lead author, in the release.