What workers need from health and well-being offerings continues to evolve, and employers want to adjust how they partner with vendors tasked with addressing those concerns, according to a new survey by Willis Towers Watson.

Courtney Stubblefield, a WTW senior director, said in a press release that “high-performing health and wellbeing vendors are now vital to employers. They have become a critical component of competitive benefit and wellbeing programs and strategic to their portfolio.”

However, employers are beginning to wonder whether they’re getting their money’s worth and want to take a closer look at what vendors promise and what they actually deliver. And employers will make changes if they’re not happy with what they find, said Stubblefield.

Ellen Kelsay, president and CEO of the Business Group on Health, agreed. She told Fierce Healthcare that “employers will be more discerning in their purchasing decisions, placing a high bar on partners to deliver in a meaningful and sustained way to address long-standing challenges related to cost, quality, outcomes and experience, across a broad array of services that employees and patients expect and deserve.”

This, in response to “a healthcare affordability crisis that simply cannot be sustained,” Kelsay added. The Business Group comprises large employers, including 74 Fortune 100 companies, that provide coverage for about 60 million workers, retirees and their families in about 200 countries.

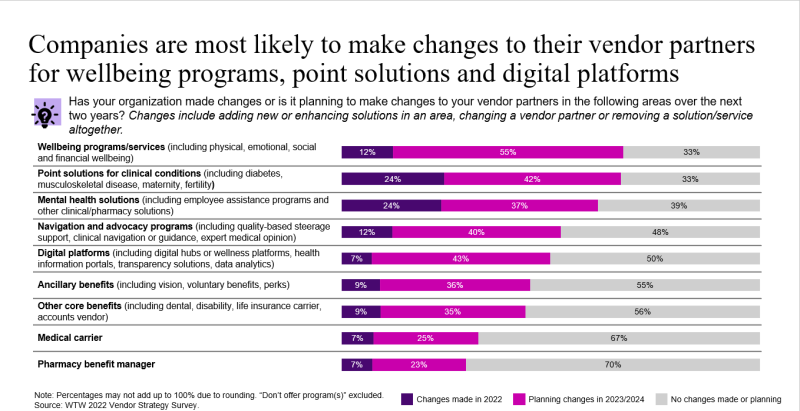

The WTW survey, conducted last November, includes 232 U.S. companies that employ about 3 million workers. It finds that:

- Over the next two years, 37% of respondents that provide mental health benefits want to add more employee mental health assistance programs, including improving access to medications that address those problems; 24% made those changes in 2022.

- 55% plan to make changes to their health and well-being offerings over the next two years, while 12% made those changes in 2022.

- 42% want to change what the survey calls “point solutions,” health and well-being programs that address particular conditions such as musculoskeletal disease, diabetes and maternity and fertility issues over the next two years, while 24% did so in 2022.

- 43% want to change their digital platforms, including digital hubs and health information portals, while 7% made those changes in 2022.

- 40% that have navigation and advocacy programs want to enhance them by including clinical guidance and expert medical opinion, while 12% made those changes in 2022.

Regina Ihrke, a WTW senior director, said in the press release that “all employers need to consider vendors as part of their strategy to address the diverse needs of their population. Companies prioritize ROI but need a broader definition of ROI that includes choices based on driving quality, filling the gap in core offerings and lowering cost. At the same time, they should evaluate if the solution is working, how to optimize current partners and whether they need to embrace innovation in the market.”

Emma Hoo, director of value-based purchasing for the Purchaser Business Group on Health, an organization comprising about 40 large private and public companies, tells Fierce Healthcare that there are several drivers behind this dynamic. “Wanting to keep a wellbeing program fresh to engage employees, and on that front, employers want better measurement and accountability for outcomes from their vendors, not just participation and engagement,” she tells Fierce Healthcare. “Another driver has to do with employers taking a broader view toward total person health.”

In addition, says Hoo, employers want to enhance digital health and wellbeing tools for workers, especially given that more individuals work remotely.

The increase in remote work isn’t the only thing that’s changed. COVID-19 caused a seismic shift in the work world as evidenced by the "great resignation" and a significant shift to home and remote work. In addition, because hundreds of thousands of providers quit during the pandemic, health and well-being programs take on added importance because of their potential to help workers avoid serious illness without provider intervention.

“Population health, in general, has continued to decline, and we’re seeing increased concern and emphasis on prevention, chronic disease, mental health, financial well-being and health equity, among other areas,” said Kelsay. “One-off or niche solutions that can neither deliver comprehensively nor effectively partner with others will likely not remain viable.”

Employers worry about fragmented patient care and want to provide comprehensive and value-based benefits, said Kelsay.

“Some solutions implemented during the pandemic may have addressed much-needed access challenges; however, other concerns have emerged that these solutions may be redundant, fail to deliver improvements in outcomes/patient experience; and have meager data on performance and quality measures,” said Kelsay. “If these solutions are not able to demonstrate necessary impact, they will likely face diminishing viability and will not be sustained.”