Large health systems are scooping up independent hospitals, and that consolidation negatively affects employers, insurers and patients, according to a new analysis backed by Blues giant Elevance Health.

However, the American Hospital Association was quick to dispute the findings, with CEO Rick Pollack telling Fierce Healthcare in an email that the analysis “draws absurd conclusions about the impact of healthcare systems on access to care, cost and quality.”

Researchers with the Elevance Health Public Policy Institute examined claims data in Elevance-affiliated plans in 20 states between Jan. 1, 2012, to Dec. 31, 2018. They compared independent hospitals that merged with a hospital system to independent hospitals that did not, according to the white paper (PDF).

Average inpatient prices for commercially insured patients rose 5% above the market average at independent hospitals that were bought by large hospital systems, according to the report. Prices increased even as operating expenses at these hospitals declined by 6% because of cuts to personnel in support positions such as general and administrative duties oversight, employee benefits management, maintenance departments, supplies monitoring and purchasing, pharmacies and medical records filing and storage.

The analysis found that hospital care, at $4.3 trillion, represents the largest segment of U.S. healthcare spending, with $1.3 trillion spent annually. A decline in inpatient volume in the last decade didn’t mean less spending, as the share of hospital spending as a share of healthcare spending rose from 30% to 31%.

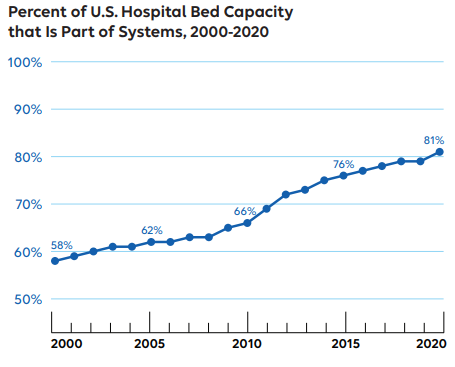

Hospital systems’ control of bed capacity increased from 58% in 2000 to 81% in 2020, the study found.

“The proportion of hospital markets without a single independent hospital increased from 7% to 25% over this same period,” the white paper said. “By 2020, 75% of markets had over half of their hospital bed capacity controlled by their two largest systems which control over 50% of the market share, nearly double the rate in 2000.”

Pollack pushed back on Elevance’s concern about costs and argues that the issue could be mitigated somewhat if the company reduced its pricing strategies, which Pollack said earned Elevance nearly $2 billion in profit in the second quarter of this year.

“Of greatest irony is that while the national health plan behemoth, which dominates many insurer markets, is pointing fingers at the actual healthcare providers serving patients, it is pocketing record profits,” he said.

Pollack said the white paper is an attempt to distract the public from how insurers delay and deny access to care, and argued that Elevance has a “notorious” reputation for being slow to pay hospitals and pre-authorize care, putting patients’ health at risk.

“This biased piece fails to recognize the immense benefits of hospital and health system mergers for patients,” Pollack said. “Perhaps the most egregious omission is the recognition that mergers often prevent struggling hospitals—especially in rural and other medically underserved areas—from closing and that it is inadequate payment by payers, like Elevance, that destabilize these providers to begin with.”

The authors of the white paper argued that having access to negotiated prices between health plans and hospitals sets this study apart from prior research that relied on estimates based on data reported to the Centers for Medicare & Medicaid Services. They cite recent studies that show the estimates to be unlike the actual prices.

Prior research did not evaluate what happened to efficiency when large health systems subsume independent hospitals as does this study, said the authors. In addition, the authors said that they look at what happens to quality at acquired independent hospitals, something that they say prior research more or less ignored.

The white paper concluded that larger systems buying up independent hospitals exposes patients and payers “to higher prices without a commensurate increase in quality of hospital care. Further, access to care does not improve, with acquired systems no more likely to expand access to medical technology or services. Instead, patients are likely to experience a reduction in access to maternity wards and reduction in staff.”

Richard Stefanacci, D.O., of the Jefferson College of Population Health at Thomas Jefferson University and who was not involved with the study, told Fierce Healthcare in an email that Elevance’s findings point to the benefit of the acquisition of independent hospitals by health systems, but the money saved because of better efficiencies needs to be used correctly.

“There’s an opportunity to capitalize on the additional resources gained through these mergers by directing them towards enhancing the value of healthcare delivery,” said Stefanacci.

Stefanacci believes that the money saved should be used to bolster value-based care to ensure better access to providers while effectively managing costs. The Community Health Needs Assessment could be used to hold health systems accountable for assessing the needs of specific communities to serve the populations therein appropriately, he said.