COVID-19 led to huge declines in care utilization, and insurers are still feeling the effects as they must dole out more than $1 billion in premium rebates this fall.

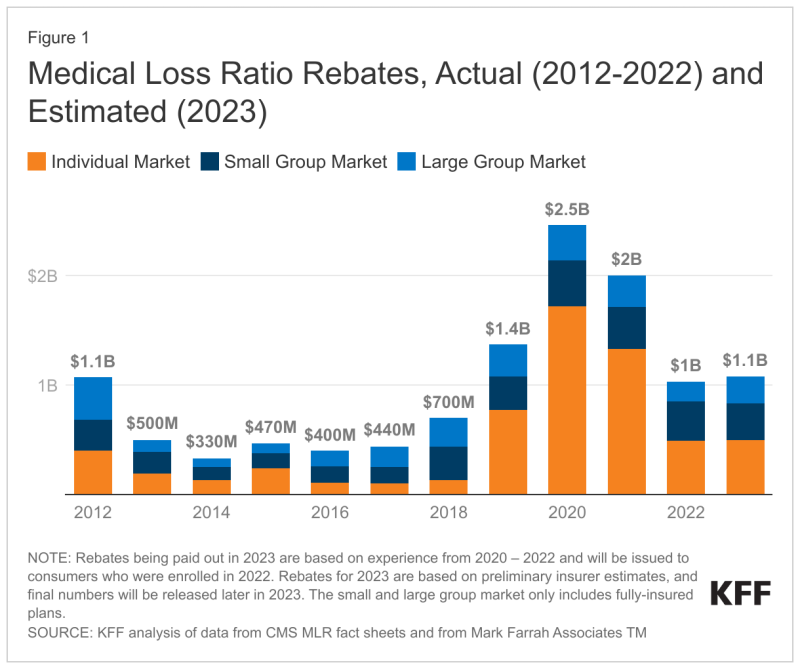

Payers will need to shell out about $1.1 billion in rebates, according to an analysis by the Kaiser Family Foundation based on data from state health insurance regulators compiled by Mark Farrah Associates.

Under the medical loss ratio rule in the Affordable Care Act, insurers must spend between 80% and 85% of their premium revenue on providing healthcare, with rebates based on the previous three years of experience. The three years previous to 2023—2020, 2021 and 2022—include the pandemic, when many providers didn’t offer routine care because they were too overloaded with COVID-19 patients, and many members decided to forgo care because of fear of being exposed to the virus.

The $1.1 billion figure may change, because some insurers have yet to file their rebate estimates, the researchers said. In addition, about two-thirds of covered workers belong to self-funded health plans, for which the MLR rule doesn’t apply.

While the $1.1 billion that health insurers need to pay in rebates looms large, it is far less than the $2 billion that they paid in 2021 or the record-setting $2.5 billion that they paid in 2020, the peak of the pandemic.

Nonetheless, those numbers need to be put in context, Brad Ellis, senior director of North American insurance at the credit rating agency Fitch Ratings, told Fierce Healthcare.

“The health insurance sector in the U.S. in 2020 generated nearly a trillion dollars in premium revenue, and so $1.1 billion is not much in terms of the overall picture,” Ellis said. Though he noted that MLR rebates did jump substantially in 2020.

Also, there’s no denying that the pandemic caught the insurance industry off guard, Ellis said.

“The last time we had a pandemic was over 100 years ago,” Ellis said. “I think everyone, including us, didn’t realize how much utilization would go down. This surprised the entire healthcare industry, including providers.”

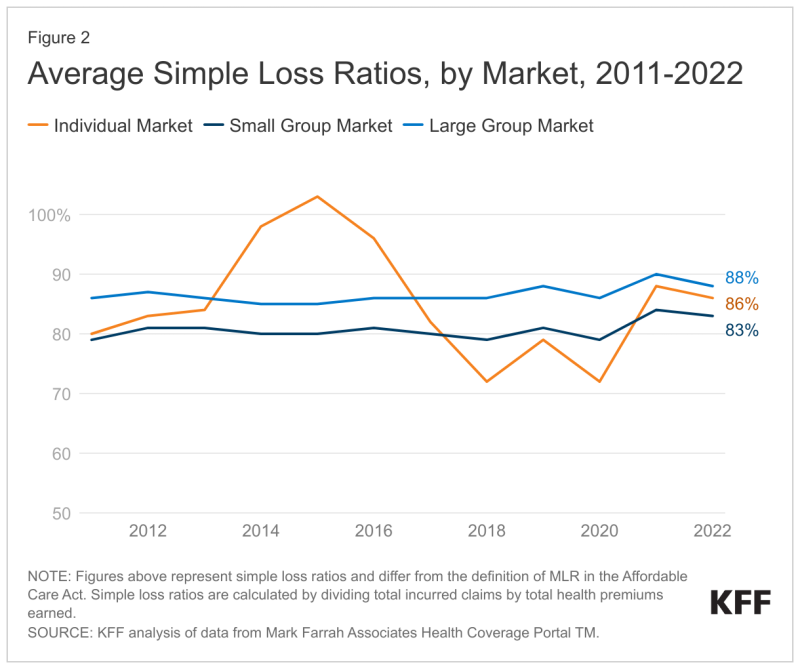

The KFF analysis found that “in the small and large group markets, 2022 average simple loss ratios were 83% and 88%, respectively."

Ellis said that health insurers operate in a competitive environment.

“They don’t want to be on the other side of that 80% to 85%,” Ellis said. “If you spend more than 85%, you don’t get that back, really. It’s a lot better if they maybe spend a little bit less in certain areas, and then have to give it back.”

He also stressed how highly complicated computing an MLR can be: “It’s pretty amazing that they come pretty close to the number, and I think, absent the pandemic, the industry as a whole has done a really good job of estimating or predicting healthcare costs and utilization.”

According to KFF, about 2.4 million people with individual coverage received a rebate last year, as did about 3.8 million people in employer-sponsored health plans, though those rebates can be shared between employees and employers. The MLR losses might result in health insurers passing the cost down to members.

“Another year of higher loss ratios in the individual market may foretell further premium increases in 2024, as some insurers will aim for lower loss ratios to regain higher margins,” the analysis said. “In recent years, insurers in all markets had experienced a great deal of uncertainty in setting premiums during the pandemic. Looking ahead to 2024, some of that uncertainty may continue, specifically relating to pent-up demand or the health effects of missed and delayed care.”

The mantra when it comes to pandemics is still “not if, but when,” according to most experts. Ellis said the insurance industry will be better prepared.

“They did gain a lot of knowledge about insurance behavior, about public behavior,” Ellis said. “That’s valuable in terms of just providing support. Remember that there weren’t a lot of diagnostic codes in existence that match the coronavirus. It was really the Wild West in terms of submitting claims. Hospitals were overwhelmed. Claims were based on some other code for pneumonia, inpatient pneumonia with complications, comorbidities, things like that. I think they’re more prepared at this point.”