Embattled insurtech Bright Health is down to the wire to avert a potential bankruptcy, and threats from the New York Stock Exchange about delisting its shares also loom in the coming months.

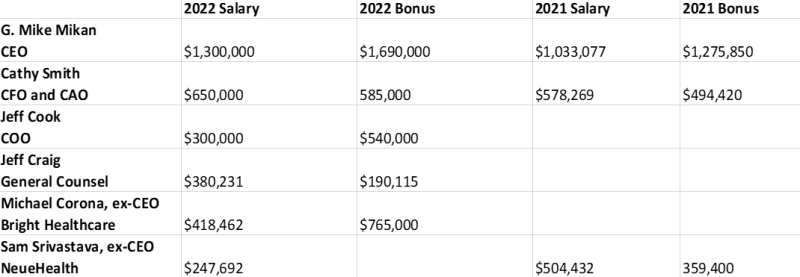

Meanwhile, its management team awarded themselves over $4 million in bonuses last year, despite these financial challenges.

It’s no wonder that one expert told Fierce Healthcare that the company is a “walking disaster.” Ari Gottlieb, a nationally known healthcare strategist, said the company should immediately be placed into receivership by the insurance agencies in states where it now operates.

“And it’s unfortunate for the thousands of their employees who will eventually lose their jobs and the individual investors, some of whom have lost their life savings for believing in a management team that’s consistently misled investors,” Gottlieb said.

As of the end of last year, Bright employed 2,840 people, according to a recent filing with the Securities and Exchange Commission. Bright Health cannot pay claims—the basic obligation of a payer, said Gottlieb. In addition, Bright continues to lay off workers, between 600 to 800 according to recent public filings, and its stock has plunged, closing last Friday at 22 cents.

“How can state health insurance regulators be OK with this?” Gottlieb said.

A spokesperson for Bright told Fierce Healthcare in an email that “we don’t comment on executive compensation. To your source’s comments on claims, Bright HealthCare continues to actively pay claims in each of the markets it is exiting.”

The bonuses for Bright Health executives came after the company lost $1.6 billion last year, and was placed under supervision in Tennessee and Florida. Illinois is considering taking a similar step. The health plan’s foothold in Alabama, Arizona, California, Colorado, Georgia, Illinois, New York, North Carolina, Ohio, and South Carolina seems to be slipping. The company announced that it will no longer offer individual, family, or Medicare Advantage plans outside of California. In addition, the company recently notified its beneficiaries in Texas who buy healthcare coverage in the Affordable Care Act marketplace exchange that their coverage will end on July 31, 2023.

The insurtech this week sent a letter to shareholders asking them to attend a meeting on May 4 in which company officials will ask for approval of a reverse stock switch “at a ratio of not less than 1-for-15 and not greater than 1-for-80,” according to an SEC filing.

Bright could be delisted from the New York Stock Exchange on June 6 if a share of its stock isn’t worth at least $1 and maintains that worth for 30 days. The insurer also disclosed earlier this month that it needs to raise about $300 million to avoid bankruptcy after it overdrafted its credit.

In a LinkedIn post, Gottlieb stated that “Bright ended 2022 with $55 million in total capital and acknowledged without additional capital they likely will not be able to pay liabilities including risk adjustment payables to the government.”

Nonetheless, Bright issued 60 million shares of restricted stock in 2023, 10% of the outstanding shares worth about $482.48 at the close.

Gottlieb said that the company is “making a mockery of the regulatory supervision process.”

“And the board turns around and pays management millions of dollars of cash bonuses," he said. “Oh, and the CEO got to fly around for personal use on the company’s jet.”

At the beginning of the month, Bright Health executives told investors that they needed to raise $300 million by the end of April in order to stave off bankruptcy.

CEO Mike Mikan said the company ran into an unexpected $70 million hit on investment income and a settlement of more than $1 billion for risk adjustment on its now-defunct Affordable Care Act insurance business. He told investors that management wants to find a source for more cash infusion and establish a long-term capital structure.

“We recognize that at this stage we have much to prove and that is exactly what we intend to do,” Mikan said at the time. Last year, Mikan earned $1.3 million in salary and got a nearly $1.7 million bonus.

Gottlieb countered that Bright’s situation cannot be summed up as simply having “much to prove,” as Mikan says.

“It’s literally on life support with a terminal illness,” Gottlieb said.