Entrepreneur Max Kauderer thinks the company he has co-founded, a third-party administrator called Yuzu Health, can disrupt major insurance companies by helping offer small businesses more affordable health plans for its employees.

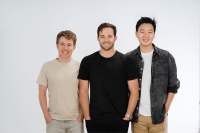

Yuzu Health is a New York City-based startup created by Kauderer and two engineers, Russell Pekala and Ryan Lee, that seeks to simplify claim processing through AI and machine learning. It connects employers to traditional network-based plans and newer models like reference-based pricing and direct primary care to integrate with provider networks and pharmacy benefit managers.

The company announced on Halloween a $5M seed funding investment from Lachy Groom, the first major investment the company has received, with participation from Neo, Day One Ventures, Altman Capital, WndrCo, Browder Capital and unicorn founders from OpenAI, Stripe, Coalition, Lattice and more. Many of the investors told Yuzu that they resonated personally with the problems they are trying to solve. The $5M will be used to expand the team and strengthen and simplify the software’s underlying technology.

The investors see Yuzu Health serving a customer segment desperate for better options. Small businesses and startups pay on average $22,463 for basic family coverage, according to KFF. That may not matter for Fortune 500 companies and big tech firms capable of self-funding, but it is a devastating figure for lean operations still on the way up.

“High level what we’re trying to do is break down the cost of health insurance for small businesses and make higher quality benefits more affordable,” Kauderer told Fierce Healthcare in an interview.

While most TPAs only work with large companies to pull in vendors and experiment with plan design, Yuzu Health prioritizes small businesses, since those organizations can’t dedicate the administrative and underwriting brunt toward self-funding plans. Yuzu Health will partner with plan designers and brokers to offer customizable plans at companies as small as five employees (the same number of workers that Yuzu currently employs) up to several hundred.

The company said in a statement that legacy insurers operate within outdated models, with no incentive to change, that see members pay expensive premiums for plans that don’t fit their needs.

“These massive insurance companies end up being able to charge high prices, but their technology is really brittle,” said Kauderer, noting that Yuzu customers can turn on plans in mere days versus the three-to-six-month industry standard. “There’s no flexibility to new plan design.”

Kauderer thinks Yuzu can provide members with price transparency that big insurers won’t. The company’s technology embraces artificial intelligence and machine learning to analyze plan documents and answer member questions instantaneously, saving the employer time and up to 40% in costs rather than dealing with the manual claims process.

It can also help members understand the cost of procedures and gives the AI the opportunity to prompt beneficiaries to local providers that are more affordable than others through a dynamic homepage, all while tracking claims in real time.

“It’s unbelievable how much insurance costs and how much it’s increasing year-over-year,” he said. “So anything we can try to do to bring down that cost and improve member experience, especially for small groups, is what we’re motivated by.”

The company launched less than two years ago, and now offers 10 plans for thousands of members, reports Insider. It aims to become the default operating system for all types of new plans. Yuzu Health charges a flat per-member-per-month fee.