Medicare Part D drug prices have increased by an average of 226% since market entry. These 25 drugs are responsible for $80.9 billion in total Part D spending in 2021.

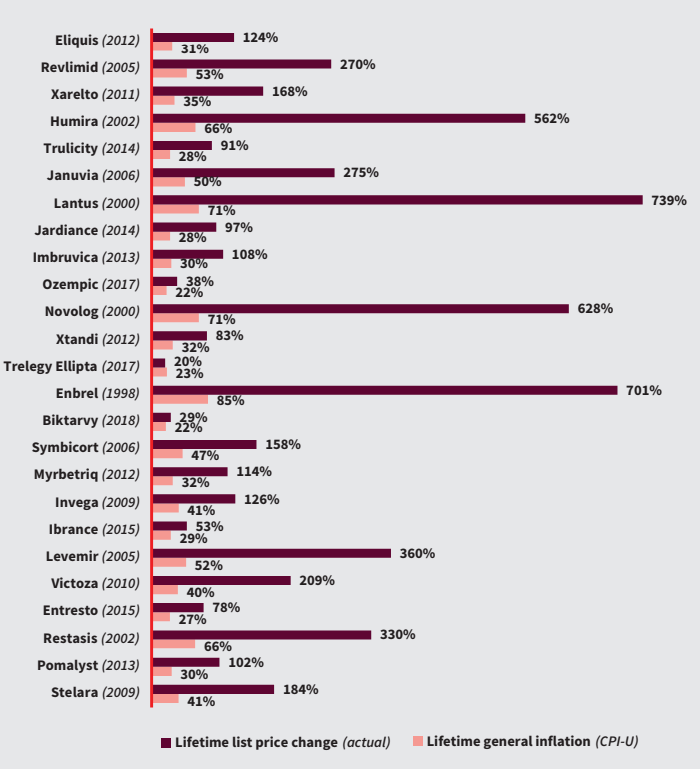

The new report (PDF) from AARP’s Public Policy Institute shows that high pharmaceutical drug prices are placing an unwelcome burden on customers. Overall, lifetime price increases among 25 name-brand drugs have increased by 20% to 739%, with just one drug exceeding the annual rate of inflation over the same period of time.

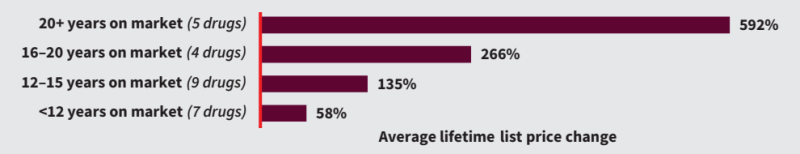

“There is no justification for drug companies to engage in these types of price increases every year that they’re on the market, particularly increases that are so much higher than the price increases for other products and services,” said Leigh Purvis, a senior director of healthcare costs and access for AARP, during a press briefing. “Our analysis shows that drugs that have been in the market for 20 years or more have seen an average lifetime price increase of 592%.”

For Enbrel, a drug that entered the scene in 1998 and is used to treat rheumatoid arthritis and psoriatic arthritis, the price has increased 701%. The diabetes drug Januvia has risen 275% in price.

Even for newer drugs, like Eliquis (2012) or Imbruvica (2013), the drugs’ prices increased 124% and 108%, respectively. If those drugs had kept in line with the rate of inflation, their prices would have only increased by about 30%. Even Ozempic has exceeded inflation by 16% since being introduced on the market in 2017.

AARP looked at the cost for 25 Part D drugs. In all almost all cases, the cost of the drugs exceeded inflation, except for Trelegy Ellipta.

“A lot less attention is paid to how those price increases are often building on top of a long line of price increases, and how those relentless price increases add up over time,” said Purvis.

Among the 25 drugs analyzed, prices were shown to increase more dramatically the longer they are on the market. Drugs sold for 20 or more years rose in price by 592%, while drugs on the market for less than 12 years accounted for a 58% increase in price.

She said that people on Medicare prescription drug plans take, on average, four to five prescription drugs per month. These drugs are often covered using coinsurance, or people are bearing the full responsibility on their own if they do not have health insurance. Oftentimes, with such staggering price increases resulting in drug costs to rise by thousands of dollars, customers must choose between medication or food and gas.

To address these choices customers must make, Congress passed the Inflation Reduction Act, which includes a provision that requires drug companies to pay a rebate to Medicare if their prices increase faster than inflation. This will reduce enrollee and Medicare spending by billions of dollars.

The analysis was released on the backdrop of the Centers for Medicare & Medicaid Services' upcoming announcement that it's expected to name the first 10 drugs to be negotiated by Medicare.